North Carolina Based Two Toasters Acquired by Ticketmaster

Recently, it was announced that Two Toasters, a design and development agency for applications on Google and Apple platforms, was acquired by Ticketmaster, a divisions of Live Nation Entertainment. While Ticketmaster had little to say about the acquisition, it did confirm on the company’s website that the acquisition “further demonstrates Ticketmaster’s commitment to expanding its mobile capacity.”

While the amount Ticketmaster paid to acquire Two Toasters was not disclosed in news reports, the American Tobacco Campus-based company will be known as Ticketmaster Mobile Studio, according to the Herald Sun. On Tuesday, March 31, Ticketmaster issued a statement saying that the acquisition of Two Toasters “further demonstrates Ticketmaster’s commitment to expanding its mobile capacity and creating a truly end-to-end platform unlike any other in the live event and entertainment space.”

According to news sources, Two Toasters has been successful in the launch of more than 50 mobile applications for a wide array of companies, some of which include Regal Entertainment Group, Birchbox, Ebates, and Airbnb, among others. Two Toasters currently employs 32 individuals. The company was founded by Adit and Rachit Shukla, brothers. The deal is an important strategic undertaking for Ticketmaster, according to sources, who say the deal establishes a solid presence for Live Nation in the Triangle.

Two Toasters’ CEO Rachit Shukla said in the statement issued by Ticketmaster that, “We’ve assembled one of the best mobile teams in the region and Two Toasters has become a magnet for new talent.” Shukla went on to say that by Two Toasters joining Ticketmaster, the company’s visions has been expanded, and the talented team given the opportunity to take ownership and build a completely new mobile standard in the industry as Ticketmaster Mobile Studio.

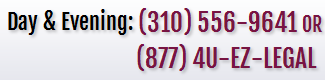

Spotora & Associates is a talented team of Los Angeles business attorneys dedicated to achieving and exceeding your business goals. We specialize in mergers and acquisitions and successfully represent businesses in a wide array of industries; if you are in the process of acquiring a new entity or being acquired, we can help you ensure all bases are covered at every step. We know the complexities involved and will provide the expertise and knowledge essential to helping you make a smart and profitable business decision. Our primary goal is to obtain your objectives in business transactions from the simplest, to the most complex. Contact us to get started right away.

RSS

RSS FAQ

FAQ Clients

Clients