What LLCs Need to Know About the Revised Uniform Limited Liability Company Act

What LLCs Need to Know About the Revised Uniform Limited Liability Company Act

Any manager or owner of a California LLC established after January 1, 2014 needs to be familiar with how the Revised Uniform Limited Liability Company Act (RULLCA) impacts their business.

Unanimous Approval Required When Issue Not Addressed

The RULLCA places certain restrictions on voting approval of certain issues that are not addressed specifically by the operating agreement. For instance, unanimous voting approval is required in order to:

● Merge the LLC with another entity or to convert the LLC to another type of entity.

● Dispose of LLC property, such as selling, leasing or exchanging the property.

● Amend the operating agreement.

● Do anything on behalf of the LLC that is outside of the ordinary course of business.

Because unanimous voting approval is required to do any of the above if it is not specifically provided for in the operating agreement, one member or manager of the LLC could stall out a decision to act on one of these matters by withholding their approval. Addressing these issues explicitly in a written operating agreement can circumvent a lot of potential headaches.

What The RULLCA Means for Agreements

Under the RULLCA, any agreement between the members of the LLC concerning the governance of the LLC is considered binding, which can create a lot of problems within the company if an agreement was made orally or was implied. Under the RULLCA, it is important to memorialize, in writing, any operating agreement concerning:

● Management’s rights and duties.

● The activities and conduct of the LLC.

● Relations between and among members of the LLC.

● How amendments to the operating agreement are to be made.

When matters concerning LLC governance are made in writing, there is less risk that members of the LLC will dispute the agreement, because the terms and conditions of the operating agreement have been documented.

Also, for LLCs that choose to be manager-managed, the RULLCA requires that this should be made explicit in both the operating agreement for the LLC, as well as in the the articles of organization.

Fiduciary Responsibilities under the RULLCA

Members or managers of an LLC owe fiduciary duties to one another and the LLC under the RULLCA; however, these fiduciary duties can be modified if they are modified in a written operating agreement, but they may not be eliminated altogether or modified in such a way that they are rendered manifestly unreasonable. Under Section 17704.09 of the California Corporations Code, those fiduciary duties include:

● The duty of care.

● The duty of loyalty.

● The duty of good faith and fair dealing.

When modifications to the fiduciary duties are made in the written operating agreement, they could be potentially drafted in a way that could open up individual members or managers of the LLC to liability for the LLC’s actions. This is because under the RULLCA, members or managers can lose their indemnification protections if the fiduciary duties of the members or managers are modified. LLC members and managers should make sure that they fully understand any modifications that have been made to the fiduciary duties in the written operating agreement before consenting to them.

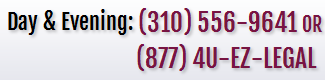

Contact our office to speak with a senior Los Angeles business attorney for more information on what RULLCA means for your business entity today.

RSS

RSS FAQ

FAQ Clients

Clients